This could result in a negative mark on your record just like with any other source of credit On the other hand because ther. If you continue to miss payments fees are capped at 25 of the purchase price and you are.

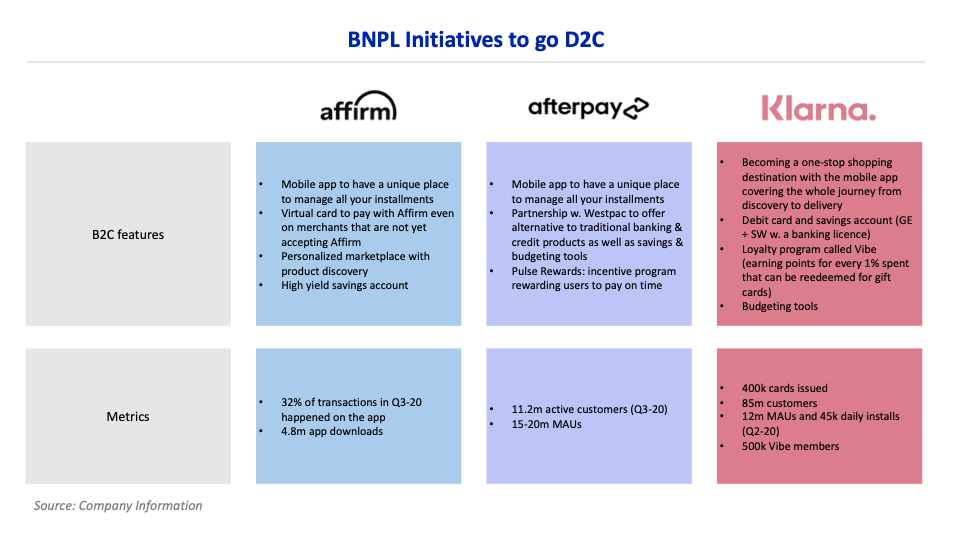

Buy Now Pay Later Solutions Are Going Direct To Consumer

Buy Now Pay Later Solutions Are Going Direct To Consumer

This could harm your credit record just like a credit card.

Does afterpay build your credit. If you live in the state of Alabama you must be 19 to use Afterpay. Does Afterpay Help Your Credit. You cant use Afterpay to build your credit history.

Afterpay doesnu2019t do a credit check before you apply and on-time payments wont improve your credit history. However Afterpays TCs do give it the authority to do so. When you successfully pay off an Afterpay loan you get a kind of in-house credit and Afterpay will agree to lend you more in the future.

Tips for maximizing Afterpay If Afterpay is still the best payment choice for you follow a few simple tips to. And the banks are getting very stringent on who they lend money to these days due to the regulator crackdown. While Afterpay does not identify as a credit service Unwin says the banks see it as such.

The key takeaway from this should be. This also means that you cant build up a good credit history with Afterpay either as it wont report positive behaviours like continually meeting your scheduled repayments. This includes things like late or missed payments defaults or.

Unfortunately making on-time payments with Afterpay does not help your credit. In the current tightening lending market this could hamper your efforts to obtain a home loan if youve racked up quite the Afterpay bill. Afterpay is authorised to make any enquiries it considers necessary to assess your capability to make payments such as ordering a credit report.

However Afterpay reserves the right to perform credit checks and to report negative activity on your account which could result in a black mark on your record just like with any other source of credit. Afterpay does not generally do a credit check when you sign-up or make purchases. Under the contract Afterpay reserves the right to check your credit and to report negative activity on your account to the credit rating bureaus.

The company doesnt pull your credit to approve you for payments either. In terms of simplicity in the application process Afterpay comes out on top. There is no credit check before you sign up for Afterpay and using it wont affect your credit score but it does reserve the right to check your credit and can report any negative activity on your account to credit reporting agencies.

But that does not mean that Afterpay cannot affect your credit score. Card providers ask customers to jump through a lot more hoops to. Afterpay also doesnt run a credit check when you sign up which may appeal to buyers whove had credit issues in the past.

Issuers perform a hard credit check when you apply which could lower your credit score temporarily. Which Store Accepts Afterpay. You do have to make regular repayments though and always on time.

Afterpay is credit neutral as long as you continue to meet your repayments. You pay off your products in instalmentsusually fortnightlyand if you miss a payment you get charged a 10 overdue fee. Afterpay and its competitors such as ZipPay are still credit liabilities and need to be disclosed when applying for a home loan.

Afterpay does not run a credit check and only charges a fee of 8 if a customer misses a payment. A history of on-time payments can establish. Users can make weekly payments on items purchased until they are paid in full.

No credit check is required to use AfterPay and no interest is charged. The banks now look on those facilities as almost an evergreen facility that at anytime you can. There is no credit check before you apply for Afterpay and it wont affect your credit history - as long as you use it responsibly.

However the fine print on the Afterpay website indicates that the company can report late payments which could affect your score. Afterpay partners with more than 25000 retailers providing an alternative to using your credit card. Since Afterpay isnt a loan company or credit union you dont need to be approved for an account like you would to get a credit card or personal loan.

If you make late payments miss payments or have other issues in maintaining your account Afterpay could report this information to the credit reporting bureaus but thats not the type of credit history you want. Using Afterpay does not affect your credit as long as you keep paying money on time. Afterpay is a lender that can help you finance purchases and pay them off over four installment payments without interest.

Afterpay reserves the right to perform credit checks and to report negative activity on your account to credit bureaus. AfterPay is a digital payment platform offered to online shoppers that allows them to delay payments on purchases. But these loans come with late-payment fees and approval isnt guaranteed.

The only criteria are that you must be 18 and have a credit or debit card you can link your account to. Credit cards versus Afterpay Winner Afterpay for simplicity but credit cards for building credit history. Unfortunately using Afterpay for purchases doesnt add any details to your credit file when you pay off the account on time.