This could result in a negative mark on your record just like with any other source of credit On the other hand because ther. If you continue to miss payments fees are capped at 25 of the purchase price and you are.

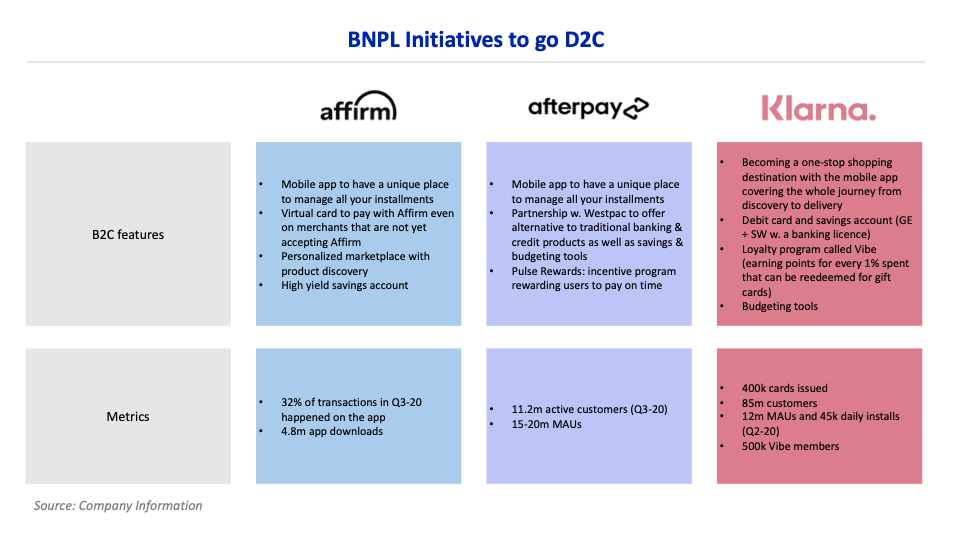

Buy Now Pay Later Solutions Are Going Direct To Consumer

Buy Now Pay Later Solutions Are Going Direct To Consumer

This could harm your credit record just like a credit card.

Does afterpay build your credit. If you live in the state of Alabama you must be 19 to use Afterpay. Does Afterpay Help Your Credit. You cant use Afterpay to build your credit history.

Afterpay doesnu2019t do a credit check before you apply and on-time payments wont improve your credit history. However Afterpays TCs do give it the authority to do so. When you successfully pay off an Afterpay loan you get a kind of in-house credit and Afterpay will agree to lend you more in the future.

Tips for maximizing Afterpay If Afterpay is still the best payment choice for you follow a few simple tips to. And the banks are getting very stringent on who they lend money to these days due to the regulator crackdown. While Afterpay does not identify as a credit service Unwin says the banks see it as such.

The key takeaway from this should be. This also means that you cant build up a good credit history with Afterpay either as it wont report positive behaviours like continually meeting your scheduled repayments. This includes things like late or missed payments defaults or.

Unfortunately making on-time payments with Afterpay does not help your credit. In the current tightening lending market this could hamper your efforts to obtain a home loan if youve racked up quite the Afterpay bill. Afterpay is authorised to make any enquiries it considers necessary to assess your capability to make payments such as ordering a credit report.

However Afterpay reserves the right to perform credit checks and to report negative activity on your account which could result in a black mark on your record just like with any other source of credit. Afterpay does not generally do a credit check when you sign-up or make purchases. Under the contract Afterpay reserves the right to check your credit and to report negative activity on your account to the credit rating bureaus.

The company doesnt pull your credit to approve you for payments either. In terms of simplicity in the application process Afterpay comes out on top. There is no credit check before you sign up for Afterpay and using it wont affect your credit score but it does reserve the right to check your credit and can report any negative activity on your account to credit reporting agencies.

But that does not mean that Afterpay cannot affect your credit score. Card providers ask customers to jump through a lot more hoops to. Afterpay also doesnt run a credit check when you sign up which may appeal to buyers whove had credit issues in the past.

Issuers perform a hard credit check when you apply which could lower your credit score temporarily. Which Store Accepts Afterpay. You do have to make regular repayments though and always on time.

Afterpay is credit neutral as long as you continue to meet your repayments. You pay off your products in instalmentsusually fortnightlyand if you miss a payment you get charged a 10 overdue fee. Afterpay and its competitors such as ZipPay are still credit liabilities and need to be disclosed when applying for a home loan.

Afterpay does not run a credit check and only charges a fee of 8 if a customer misses a payment. A history of on-time payments can establish. Users can make weekly payments on items purchased until they are paid in full.

No credit check is required to use AfterPay and no interest is charged. The banks now look on those facilities as almost an evergreen facility that at anytime you can. There is no credit check before you apply for Afterpay and it wont affect your credit history - as long as you use it responsibly.

However the fine print on the Afterpay website indicates that the company can report late payments which could affect your score. Afterpay partners with more than 25000 retailers providing an alternative to using your credit card. Since Afterpay isnt a loan company or credit union you dont need to be approved for an account like you would to get a credit card or personal loan.

If you make late payments miss payments or have other issues in maintaining your account Afterpay could report this information to the credit reporting bureaus but thats not the type of credit history you want. Using Afterpay does not affect your credit as long as you keep paying money on time. Afterpay is a lender that can help you finance purchases and pay them off over four installment payments without interest.

Afterpay reserves the right to perform credit checks and to report negative activity on your account to credit bureaus. AfterPay is a digital payment platform offered to online shoppers that allows them to delay payments on purchases. But these loans come with late-payment fees and approval isnt guaranteed.

The only criteria are that you must be 18 and have a credit or debit card you can link your account to. Credit cards versus Afterpay Winner Afterpay for simplicity but credit cards for building credit history. Unfortunately using Afterpay for purchases doesnt add any details to your credit file when you pay off the account on time.

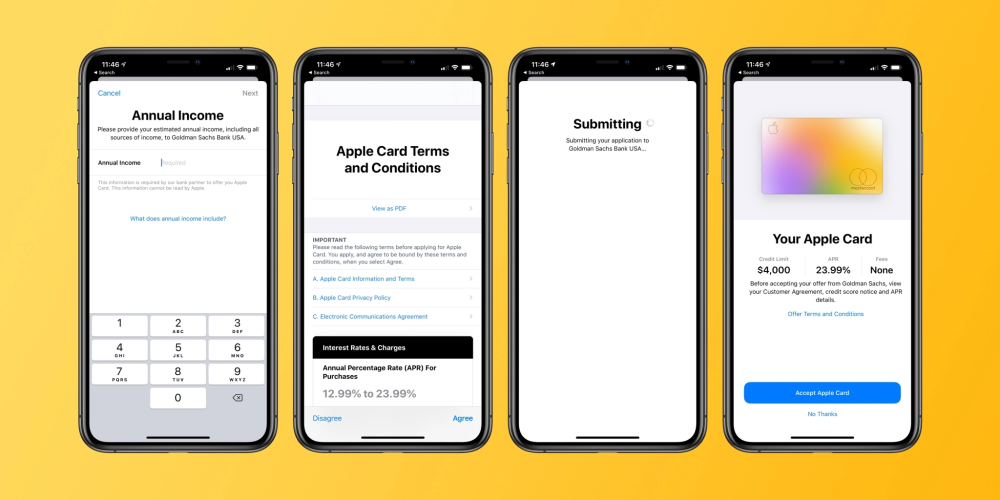

Having a low credit score means your application might be rejected. Thanks for your interest in Apple Card.

Apple Card Approval Odds Rewards And More 9to5mac

Apple Card Approval Odds Rewards And More 9to5mac

Apple says approval takes minutes so the whole process probably takes about as long as it would when applying for a store card.

How long does apple credit card approval take. Get a letter in the mail confirming or denying your application. Apple Pay is a safer way to pay that helps you avoid touching buttons or exchanging cash. The best way to use Apple Card is with Apple Pay the secure payment technology built into iPhone Apple Watch iPad and Mac and accepted at 85 percent of merchants in the United States.

Took me 5 weeks instead of 5 minutes to get approved for an Apple Card. Once you agree your application is submitted to Goldman Sachs for approval. After your approval you can request to have your physical titanium Apple Card delivered with Apple saying it.

Apple Card offers an APR between 1324 and 2424 based on your credit score and all approved cardholders will be placed at the bottom of the interest tier they fall into which will save everyone a little bit of interest. Applicants of the following credit cards will get an email confirming their approval which will include your credit limit. Such a wide range is a promising indicator that Apple is willing to approve those without the most stellar credit score but you can expect a higher interest rate and a lower credit.

After I reapplied I got approved. Once your approval is confirmed youll also find out the credit limit youve been approved for unless youve applied for a credit card with no preset spending limit. After getting an invite to do an early apply I signed on and was rejected repeatedly because my ID failed.

The billing address you used to complete your titanium Apple Card application is the address your titanium Apple Card ships to. Applied again after waiting 31 days and uploaded my drivers license scan for about the 10th time and made it to held for review. Due to the current covid-19 situation there may be a delay in the processing of your card application.

How your Apple Card application is evaluated - Apple Support. Most online applications take just 10 to 15 minutes to fill out but there is a wait time for the card application to be approved or rejected and then a further wait time until the card is despatched or put in the post by the card provider. Your registration will be approved by Apple and Goldman Sachs before youll be able to start using Apple Cash.

This should arrive within 7-10 days although in some cases it could take up to 30 days Get a message stating you will have a decision within 2 weeks. Both Apple Support and GS said to keep trying so I did and after 6 tries was locked out for 30 days. Then in 7-10 business days youll receive your credit card in the mail.

And with every purchase you make using your Apple Card with Apple Pay you get 2 Daily Cash back. The physical card will be ready 2 working days after approval and will be sent via normal mail. The Path to Apple Card program seeks to demystify the approval process and offer participants specific actions they can take to improve their candidacy in.

Retry your Apple Card application within 14 days in the Wallet app or online to get Apple Card. Your card is shipped free of charge and a notification is sent to your iPhone when it ships. Q How long does it take for Apple to approve the Apple Card request.

Hi it could take several days. Goldman Sachs Bank USA received your applications on April 5 2021 and incorrectly declined it due to a system issue. A Apple and Goldman Sachs will approve Apple Card applications in real-time.

If you applied for Apple Card and your application got approved you can request a titanium Apple Card upon accepting your offer. However one Gizmodo commenter on a previous Apple Card story noted they were approved for a limit of 6000 at the highest interest rate of. All approved applicants have the option to request a physical card which is delivered within six to eight days my card came in five days.

If you require your card earlier please call 1800 222 2121 for more information. On another note Barclays is known to make applications go into review. Goldman Sachs will need your credit history with Apple Card to inform any request for credit limit increases on Apple Card and this can take six months or more.

If your credit card approval is not instant it could take up to 10 business days to process the application manually. I received a notification when my card shipped via FedEx. While Path to Apple Card wont give you any new information about why your application was unsuccessful it could serve as a valuable roadmap and ensure you stay on track with your credit building efforts.

The Path to Apple Card program typically lasts four months. If you suspect things are lingering too long then check with the reconsideration line number below.