Bernie Sanderss wealth tax proposal. Sanders unveils plan to tax companies with high-earning CEOs Bernie Sanders has a new plan to reduce the widening gap between the rich and poor.

The thing being something that economists like to point to.

Bernie sanders higher taxes. 250 million to 500 million. It would apply when the CEO pay is. Bernie Sanders says that rich people rich people like him and his wife that is should pay higher taxes.

It is fully paid for by a wealth tax on the top 01 percent those who have a net worth of at least 32 million. That adds up to a big increasebut it also means. In 2016 and 2017 when Sanders also earned significant income from his books his effective tax rate was 35 percent and 30 percent respectively.

In 2018 Sanders adjusted gross income was 561293. Biden and Democrats have been holding talks with Republican lawmakers over a series of infrastructure. Think pre-Kennedy 91 top marginal rates if he has his way.

Bernie and his ilk are so focused on how bad the poor have it that theyll let. Bernie Sanders has pulled back the curtain on how he would pay for his 14 trillion a year Medicare for All proposal. Bernie Sanders Is Mostly Right About the SALT Deduction The state and local tax deduction overwhelmingly benefits rich households in high-tax states while shifting their federal tax.

Bernie Sanders says hell raise taxes on the 1 to levels that will make your head spin. He paid a 26 percent effective tax rate on that adjusted gross income. Bernie Sanders SenSanders 15 May 2021.

Stealing from the peace lovers to go bomb some more orphans in AsiaWebsite. Some key details from Sanders tax returns include. It would apply when the CEO pay is at least 50 times the medi.

Yes he really said that. Bernies wealth tax will raise a total of 435 trillion Click here to read the tax. Huge tax breaks for billionaires higher taxes for millions of middle-class families.

50 million to 250 million. CNBCs Robert Frank reports on presidential candidate Bernie Sanders new income inequality tax. Bernie Sanders does not voluntarily pay those higher taxes he thinks rich people should pay.

Bernies proposal to guarantee universal childcare and pre-school to every family in America who needs it will cost 15 trillion. Presidential candidate Bernie Sanders on Monday laid out a plan to hike taxes on big companies with wide pay gaps between executives and rank. Mehr von Bernie Sanders auf Facebook anzeigen.

The same Republicans who voted for trillions in tax breaks for the top 1 and large corporations now want to increase taxes on working families through user fees more toll roads and higher gas taxes while cutting Social Security Medicare and Medicaid. Senator Bernie Sanders I-VT would increase federal taxes by more than 23 trillion over 10 years according to a new analysis by the Tax Policy Center. Sanders says hed pay for that with a new 22 income-based health care premium tax as well as a 62 payroll tax paid for by employers.

New revenues would pay for universal health care education family leave rebuilding the nations infrastructure and more. 1 percent marginal tax rate. But want to raise taxes.

The same Republicans who voted for trillions in the tax breaks for the top 1 and large corporations now working families through user fees more toll roads and higher gas taxes while cutting Social Security Medicare and Medicaid. Much higher taxes primarily on the richest households. Unbelievable but true.

Mehr von Bernie Sanders. Theres a difference between expressed preferences and revealed. Hes thus not really in favour of higher taxes upon rich people is he.

Excluding tax hikes to. Nobody except Republican campaign contributors thinks that that. 32 million to 50 million net worth.

Sanders views higher taxes as a means to pay for bigger health-care housing education and climate-change programs and those plans would cost at least 40 trillion over a decade according to. Senator Bernie Sanders a progressive independent from Vermont accused Republican colleagues of attempting to increase taxes on working families as they continue to negotiate with Democrats and President Joe Biden over the administrations proposed American Jobs Plan. The presidential candidate and decadeslong crusader.

Presidential candidate Bernie Sanders proposes significant increases in federal income payroll business and estate taxes and new excise taxes on financial transactions and carbon.

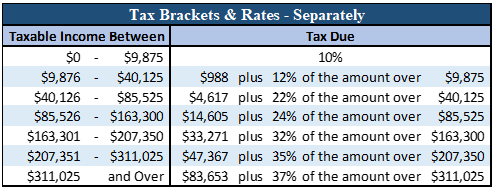

When Are Taxes Due. These are the numbers.

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

WASHINGTON The Internal Revenue Service successfully opened the 2020 tax filing season today as the agency begins accepting and processing federal tax returns for tax year 2019.

When are taxes being released 2020. 2020 IRS Tax Refund Processing Schedule in 2021. However if youre mailing documents to the IRS expect massive delays. In 2021 the IRS will begin e-File on February 12 2021.

This of course was before the coronavirus pandemic hit and health directives closed. 2020 Tax Refund Schedule 2019 Tax Year The IRS e-file Open Date was scheduled for January 21 2020. The IRS is mailing letters to some taxpayers who claimed the 2020 credit and may be getting a different amount than they expected.

The filing deadline for tax returns has been extended from April 15 to July 15 2020. Jan 31st 2020. However if you mail in your return you can expect to add at least 12 weeks to your processing time at the low end.

More than 150 million individual tax returns for the. Last year the IRS pushed back to July 15 2020 the filing deadline for 2019 taxes due to the ongoing Coronavirus pandemicIf you still cant meet the tax filing. Find out if your tax refund will be late.

The deadline to submit your 2020 tax return and pay your tax bill has been pushed back a month to May 17 2021 to give people more time to file during the Coronavirus pandemic. WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. By Isaac M.

The Treasury Department and the Internal Revenue Service are providing special tax filing and payment relief to individuals and businesses in response to the COVID-19 Outbreak. The IRS officially opened the 2020 income tax season on Monday January 27 when it. At first the deadline for filing your taxes was Wednesday April 15.

For 2020 tax returns the IRS said it planned to issue more than 90 of refunds within 21 days of e-filing. March 21 2020. January 31 2020 - 919 am EST.

Also you are legally allowed to mail in your 2020 tax return starting on January 1 2021. January 28 2020 - 1119 am EST. It took months and months to clear through the backlog in 2020 and the IRS is still delayed on taking care of mail returns.

The IRS officially opened the 2020 income tax season on Monday January 27 when it started. Some refunds could take as little as 14 days. IR-2021-76 April 5 2021 As people across the country file their 2020 tax returns some are claiming the 2020 Recovery Rebate Credit RRC.

After a years-long battle to obtain Trumps tax returns the New York Times has revealed that the president paid just 750 in federal income taxes. This may affect people who filed early in the year. But that deadline was pushed back in March to Wednesday July 15.

IR-2020-20 January 27 2020. So tax season should start in late January 2020 The IRS is also continuing to delay processing by 2-3 weeks of income tax returns with the Earned Income Tax Credit EITC or Child Tax Credit. Heres When You Can Look Forward to Your 2020 Tax Refund The Internal Revenue Service began accepting returns on Monday January 27.

Check our 2020 tax refund schedule for more information or use the IRS2Go app to learn your status. Thats the latest start to tax season weve ever seen. The deadline to file a 2019 tax return and pay any tax owed is Wednesday April 15 2020.

My numbers are based on an expected IRS receipt date beginning on the open of tax season January 27 2020 through the close of tax season on April 15 2020. The IRS urges taxpayers who are owed a refund to file as quickly as possible. Start Date Tax Return Accepted by IRS WMR status Return Received IRS Refund Accepted Week Ending Date WMR status Refund Approved Estimated Refund Date via Direct Deposit Estimated Refund Date via Paper Check February 12 2021.

The Internal Revenue Service IRS has announced the annual inflation adjustments for the year 2020 including tax rate schedules tax tables and cost-of-living adjustments. The pandemic in 2020 caused the IRS to extend the 2019 tax filing deadline from April 15 2020 to July 15 2020.

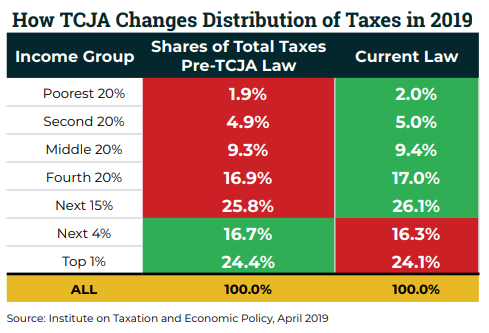

The individual income tax is highly progressive a small group of higher-income taxpayers pay most of the individual income taxes each year. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit.

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

While geography is the big factor in how much you pay a new study from real estate database and consultancy RealtyTrac breaks it down along other lines including how long a person has owned a home and how much the home is worth.

Who pays the most taxes in america. The list focuses on the main indicative types of taxes. You pay 765 percent out of your paycheck and your employer also pays another 765 percent. As a result the bottom 50 paid just 3.

The top 50 of taxpayers paid 97 of all federal income taxes in 2017 the last tax year for which comprehensive and vetted statistics are available according to the Tax Foundation. Among the 153 million Americans who filed tax returns in 2018 the average federal income tax payment was 15322 according to the most recent IRS data based on 2018 federal income taxes. Corporate tax individual income tax and sales tax including VAT and GST but does not list capital gains tax.

However economists have found that employers pay that tax by taking it out of workers wages. For Americas homeowners its not just where you live that determines what your current property tax bill looks like relative to others. In 2001 the latest year of available data the top 5 percent of taxpayers paid more than one-half 533 percent of all individual income taxes but reported roughly one-third 320 percent of income.

However even with substantial tax expenditures the top one percent of American taxpayers still pay an effective tax rate of 29 percent on average while the bottom 20 percent of the population pay an average of 3 percent.

.png)